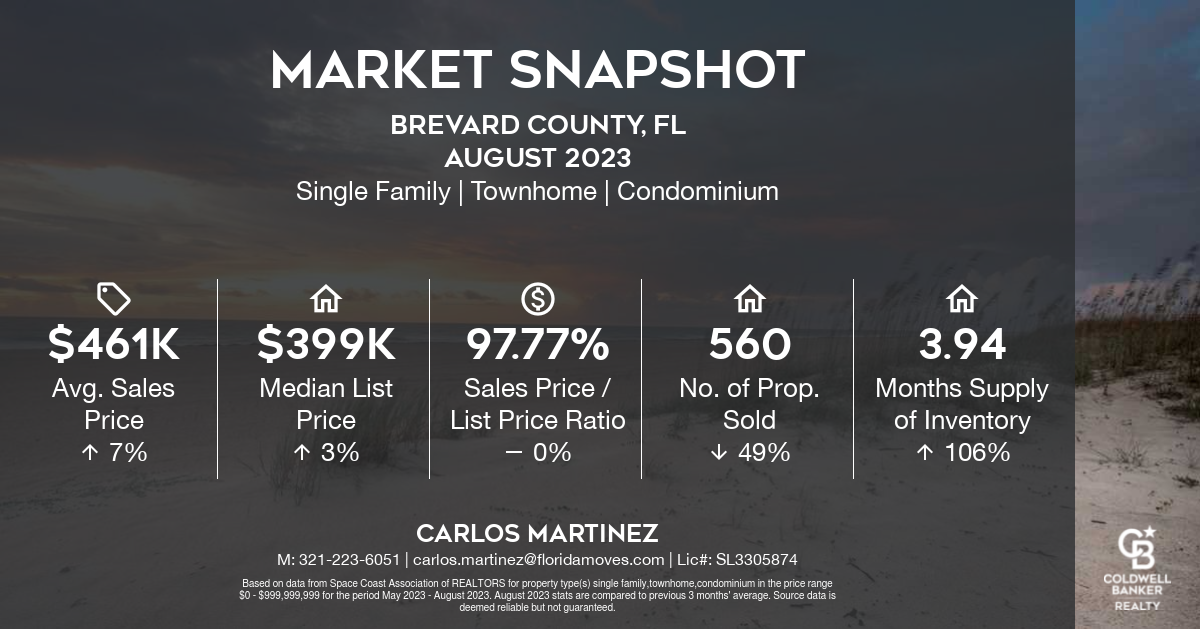

Market Snapshot for August 2023

**Exploring the Vibrant Real Estate Market of Brevard County, Florida – August 2023 Update**

As the summer heat continues to embrace the picturesque landscapes of Brevard County, Florida, the local real estate market is sizzling as well. In this month’s update, we delve into the latest trends and statistics for single-family homes, townhomes, and condominiums. The numbers paint a promising picture, indicating robust growth and a dynamic market that’s attracting both buyers and sellers alike.

**Average Sales Price Soars to $461,000 with a 7% Increase**

One of the most significant highlights of the August 2023 Brevard County real estate market update is the remarkable increase in the average sales price for residential properties. As of this month, the average sales price has reached an impressive $461,000, reflecting an impressive 7% surge. This surge signifies the area’s desirability and the strong demand for housing options across the county.

**Median List Price Climbs to $399,000 with a 3% Increase**

For those considering selling their homes or investment properties, the market conditions are undoubtedly favorable. The median list price in August 2023 stands at $399,000, marking a commendable 3%. This upward trend speaks volumes about the confidence sellers have in the current market’s stability and potential for profit.

**Sales Price List Price Ratio at 97.77% – A Balanced Market for Buyers and Sellers**

The Brevard County real estate market has maintained a healthy balance between buyers and sellers, evident from the Sales Price List Price Ratio of 97.77%. This ratio showcases the equilibrium between the initial listing price of properties and the final selling price they command. Both parties can negotiate and transact with confidence, knowing that fair deals are being struck.

**Robust Sales Activity: 560 Properties Sold**

The momentum of the Brevard County real estate market is palpable, with a total of 560 properties successfully changing hands in the month of August. This robust sales activity further demonstrates the resilience and popularity of the county as a sought-after destination for both residents and investors.

**Inventory Levels and Months of Inventory**

For those keeping a close eye on market trends, the inventory levels and months of inventory provide crucial insights. As of August 2023, the market has maintained a balanced supply-demand ratio, with a comfortable 3.94 months of inventory available. This means that at the current sales pace, it would take approximately 3.94 months to deplete the available inventory, striking a harmonious balance between supply and demand.

In conclusion, the Brevard County real estate market continues to shine in August 2023, with impressive price growth, healthy sales activity, and balanced market conditions. Whether you’re a potential buyer, seller, or investor, the current trends indicate a dynamic environment that welcomes various opportunities. As the summer sun sets over the Atlantic coast, the Brevard County real estate market remains illuminated by the promise of a thriving and prosperous future.

Sellers: Don’t Let this hold you back

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles.

Challenge #1: The Reluctance to Take on a Higher Mortgage Rate

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4%.

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

The Advice: Waiting May Not Pay Off

While experts project mortgage rates will gradually fall this year as inflation cools, that doesn’t necessarily mean you should wait to sell. Mortgage rates are notoriously hard to predict. And, right now home prices are back on the rise. If you move now, you’ll at least beat rising home prices when you buy your next home. And, if experts are right and rates fall, you can always refinance later if that happens.

Challenge #2: The Fear of Not Finding Something to Buy

When so many homeowners are reluctant to take on a higher rate, fewer homes are going to come onto the market. That’s going to keep inventory low. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

Even though you know this limited housing supply helps your house stand out to eager buyers, it may also make you feel hesitant to sell because you don’t want to struggle to find something to purchase.

The Advice: Broaden Your Search

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options. Looking at all housing types including condos, townhouses, and even newly built houses can help give you more to choose from. Plus, if you’re able to work fully remote or hybrid, you may be able to consider areas you hadn’t previously searched. If you can look further from your place of work, you may have more affordable options.

Bottom Line

Instead of focusing on the challenges, focus on what you can control. Let’s connect so you’re working with a professional who has the experience to navigate these waters and find the perfect home for you.

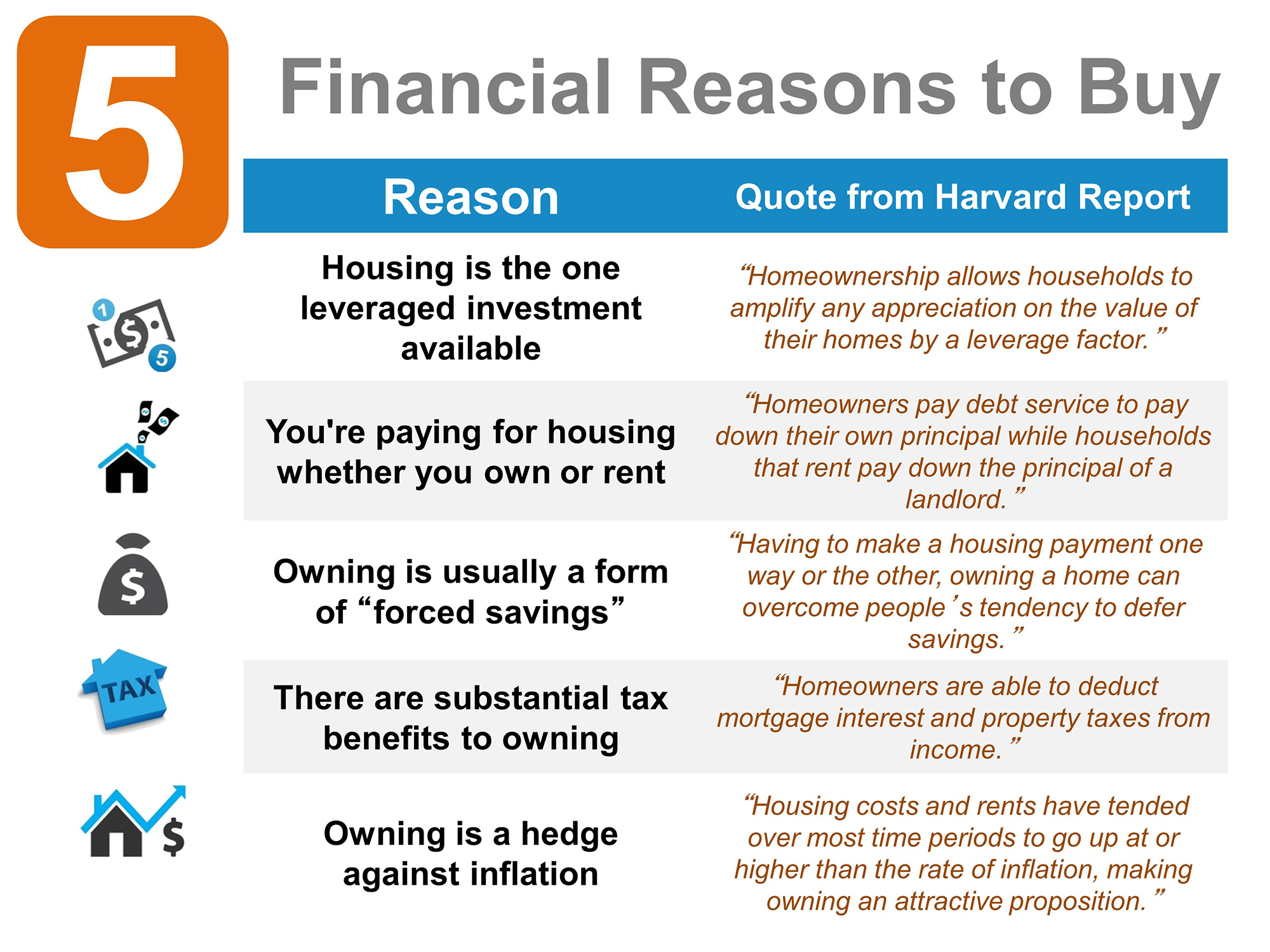

The Long-Term Value of Homeownership Despite High Interest Rates

In today’s economic climate, high interest rates have become a topic of concern for prospective homeowners. While it’s true that rising interest rates can impact mortgage affordability, homeownership still remains a financially sound decision with numerous long-term benefits. In this blog post, we will explore why homeownership is the right path to take, even in the face of high interest rates.

1. Stability and Control:

One of the primary advantages of homeownership is the stability it offers. When you own a home, you gain a sense of control over your living situation, as you are no longer at the mercy of fluctuating rental costs or the whims of landlords. High interest rates may raise the cost of borrowing, but the stability and control that come with owning a home provide peace of mind and a solid foundation for the future.

2. Building Equity:

One of the most significant long-term benefits of homeownership is the opportunity to build equity. Each mortgage payment made reduces the outstanding loan balance, thereby increasing your ownership stake in the property. Over time, as property values appreciate, you can potentially build substantial equity. This equity can then be leveraged for future financial needs, such as renovations, education expenses, or even as a source of retirement income.

3. Tax Advantages:

Homeownership offers several tax advantages that can help offset the impact of high interest rates. Mortgage interest and property tax payments are typically tax-deductible, reducing your overall tax liability. Additionally, if you decide to sell your home in the future, you may be eligible for capital gains tax exemptions (subject to certain conditions). These tax benefits can have a significant positive impact on your overall financial situation.

4. Potential for Appreciation:

Despite short-term fluctuations, real estate has historically proven to be a valuable long-term investment. High interest rates may slightly dampen the immediate appreciation potential, but over time, as the housing market stabilizes, property values tend to increase. By investing in a home now, you position yourself to benefit from future appreciation, allowing you to grow your wealth steadily.

5. Rent Savings:

When considering the impact of high interest rates, it’s important to compare homeownership costs with the alternative of renting. While rising interest rates may make homeownership seem less affordable, renting often comes with its own set of challenges. Rent payments can increase annually, and you don’t have the advantage of building equity or enjoying potential tax deductions. Over time, homeownership tends to be more cost-effective, as you are investing in an asset that can appreciate in value.

Conclusion:

High interest rates may give potential homeowners pause, but it’s important to look at the bigger picture. Homeownership offers stability, control, and the opportunity to build equity, even in the face of temporary challenges. The tax advantages and potential for long-term appreciation further enhance the financial benefits of homeownership. Rather than focusing solely on short-term interest rate fluctuations, consider the long-term value and security that owning a home can provide. By making informed decisions, you can navigate the current market conditions and embark on a rewarding journey towards homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link