In today’s economic climate, high interest rates have become a topic of concern for prospective homeowners. While it’s true that rising interest rates can impact mortgage affordability, homeownership still remains a financially sound decision with numerous long-term benefits. In this blog post, we will explore why homeownership is the right path to take, even in the face of high interest rates.

1. Stability and Control:

One of the primary advantages of homeownership is the stability it offers. When you own a home, you gain a sense of control over your living situation, as you are no longer at the mercy of fluctuating rental costs or the whims of landlords. High interest rates may raise the cost of borrowing, but the stability and control that come with owning a home provide peace of mind and a solid foundation for the future.

2. Building Equity:

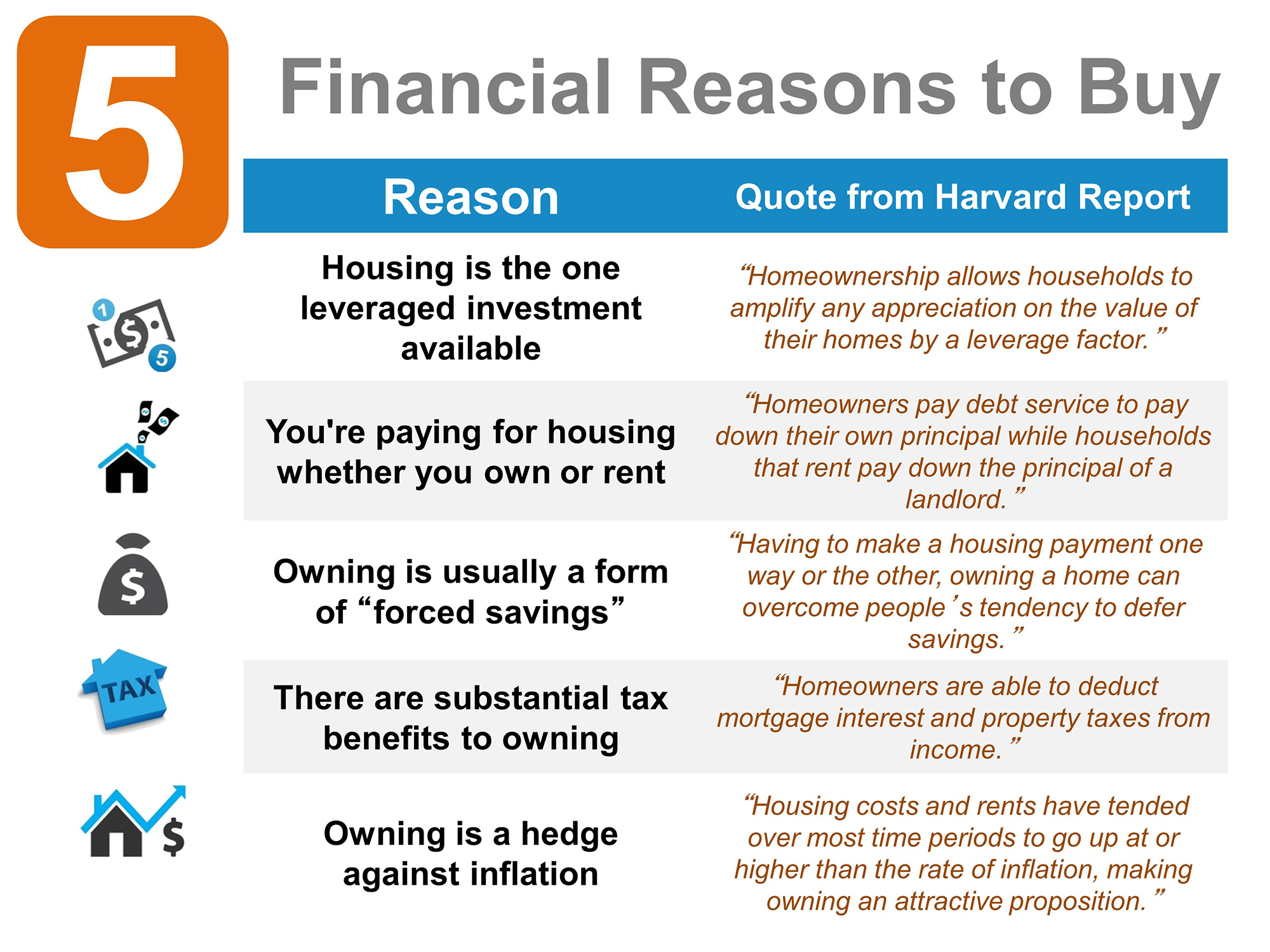

One of the most significant long-term benefits of homeownership is the opportunity to build equity. Each mortgage payment made reduces the outstanding loan balance, thereby increasing your ownership stake in the property. Over time, as property values appreciate, you can potentially build substantial equity. This equity can then be leveraged for future financial needs, such as renovations, education expenses, or even as a source of retirement income.

3. Tax Advantages:

Homeownership offers several tax advantages that can help offset the impact of high interest rates. Mortgage interest and property tax payments are typically tax-deductible, reducing your overall tax liability. Additionally, if you decide to sell your home in the future, you may be eligible for capital gains tax exemptions (subject to certain conditions). These tax benefits can have a significant positive impact on your overall financial situation.

4. Potential for Appreciation:

Despite short-term fluctuations, real estate has historically proven to be a valuable long-term investment. High interest rates may slightly dampen the immediate appreciation potential, but over time, as the housing market stabilizes, property values tend to increase. By investing in a home now, you position yourself to benefit from future appreciation, allowing you to grow your wealth steadily.

5. Rent Savings:

When considering the impact of high interest rates, it’s important to compare homeownership costs with the alternative of renting. While rising interest rates may make homeownership seem less affordable, renting often comes with its own set of challenges. Rent payments can increase annually, and you don’t have the advantage of building equity or enjoying potential tax deductions. Over time, homeownership tends to be more cost-effective, as you are investing in an asset that can appreciate in value.

Conclusion:

High interest rates may give potential homeowners pause, but it’s important to look at the bigger picture. Homeownership offers stability, control, and the opportunity to build equity, even in the face of temporary challenges. The tax advantages and potential for long-term appreciation further enhance the financial benefits of homeownership. Rather than focusing solely on short-term interest rate fluctuations, consider the long-term value and security that owning a home can provide. By making informed decisions, you can navigate the current market conditions and embark on a rewarding journey towards homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link