The excitement of purchasing a new home can be a thrilling experience, but it’s important to consider all potential challenges that might arise during the process. One such challenge is the looming threat of hurricanes and the impact they can have on real estate transactions. In hurricane-prone regions, the real estate industry has developed a concept known as the “No Bind” insurance box to mitigate the risks associated with pending storms. In this blog post, we’ll delve into what the “No Bind” insurance box is, why it’s crucial, and how potential homeowners can ensure a successful home closing even in the face of an impending storm.

Understanding the “No Bind” Insurance Box

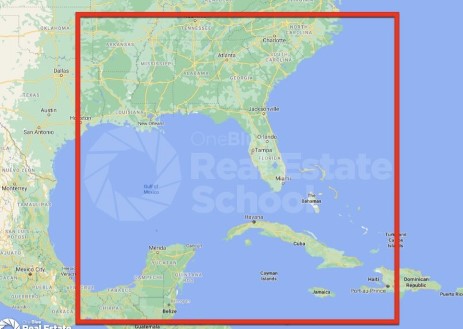

The “No Bind” insurance box is a term that has gained prominence in areas susceptible to hurricanes and severe weather conditions. It refers to a critical time period during which insurance companies temporarily halt the issuance of new insurance policies or changes to existing policies due to the imminent threat of a hurricane. This “box” typically encompasses the time when a storm is predicted to hit a certain area until it has safely passed. During this period, insurance providers focus on safeguarding their interests and minimizing their exposure to potentially significant claims.

The Significance of the “No Bind” Insurance Box

The significance of the “No Bind” insurance box cannot be overstated. For individuals in the process of closing on a new home, having adequate insurance coverage is not just a recommendation; it’s often a requirement from lenders. Without the proper insurance, a mortgage lender might not finalize the loan, potentially derailing the entire home-buying process. This creates a scenario where individuals without insurance coverage might find themselves unable to close on their dream home, leaving them in a state of limbo.

Ensuring a Smooth Home Closing During Pending Storms

1. **Plan Ahead:** Homebuyers should take into consideration the local weather patterns and historical hurricane occurrences when scheduling their home closing. Avoid scheduling closings during the peak hurricane season to reduce the risk of encountering the “No Bind” insurance box.

2. **Work with Professionals:** Engage with a seasoned real estate agent and insurance broker who are familiar with the intricacies of the local market and can guide you through potential challenges, including navigating the “No Bind” insurance box.

3. **Insurance Verification:** Long before the threat of a hurricane arises, prospective homeowners should proactively secure insurance coverage for their new property. This ensures that the insurance policy is in place well before the insurance box is triggered.

4. **Open Communication:** Maintain open communication with your insurance provider and real estate agent. If a storm is forecasted, stay informed about the insurance company’s policies regarding binding new coverage or making changes to existing policies.

5. **Contingency Plans:** Work with your real estate agent to establish contingency plans in case a pending storm disrupts the home closing process. This might include negotiating extended timelines or exploring alternative solutions to ensure a successful closing.

Conclusion

Purchasing a home is a significant life event that should not be overshadowed by the threat of pending storms. By understanding the “No Bind” insurance box and taking proactive steps to secure insurance coverage well in advance, potential homeowners can ensure a smoother closing process even when the weather forecast is less than ideal. Collaborating closely with professionals, planning ahead, and maintaining open communication can go a long way in safeguarding your investment and turning your homeownership dreams into reality.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link